The digital landscape in the United States shifted dramatically as TikTok, the wildly popular short-form video app, went dark for millions of users.

The ban, which took effect at midnight on Sunday, stems from a federal law citing national security concerns over TikTok’s Chinese ownership. While the app’s future remains uncertain, the ban has created a ripple effect across the tech industry, with potential winners emerging among other social media platforms eager to capitalize on the fallout.

The End of an Era—for Now

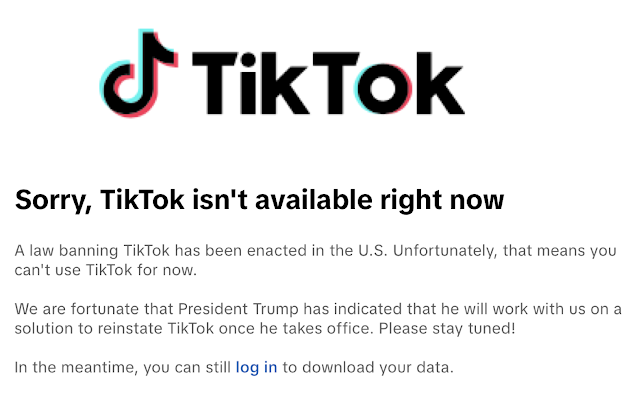

TikTok users were greeted with a stark message upon logging into the app: “Sorry, TikTok isn’t available right now.” The app also disappeared from Apple’s (AAPL) App Store and Google Play (GOOG), effectively severing its reach in the U.S. market. Although TikTok hinted at a possible resolution under President-elect Donald Trump’s administration, the immediate impact is significant.

TikTok users were greeted with a stark message upon logging into the app: “Sorry, TikTok isn’t available right now.” The app also disappeared from Apple’s (AAPL) App Store and Google Play (GOOG), effectively severing its reach in the U.S. market. Although TikTok hinted at a possible resolution under President-elect Donald Trump’s administration, the immediate impact is significant.

The ban follows bipartisan efforts in Congress to address security concerns related to TikTok’s parent company, ByteDance. Lawmakers have argued that the Chinese Communist Party could potentially access U.S. user data or manipulate content to serve its interests. While ByteDance has denied such claims, the Supreme Court upheld the law late last week, paving the way for the ban.

A Golden Opportunity for Rivals

With TikTok sidelined, major players in the social media space stand to benefit. Meta Platforms (META), the parent company of Facebook and Instagram, is poised to capture a significant portion of TikTok’s advertising dollars. Analysts estimate that as much as 70% of TikTok’s ad spend could migrate to Instagram, where ad monetization rates are approximately three times higher.

Snapchat (SNAP), another TikTok competitor, could also see an influx of users and ad revenue. However, experts caution that Snap must ensure it retains these users long-term to sustain growth. Meanwhile, Reddit (RDDT) offers an alternative with its own short-form video features and vibrant community forums, potentially appealing to displaced TikTok users.

Google and Apple might indirectly benefit as well. Both companies could see increased revenue from app developers vying to replace TikTok in the U.S. market.

With TikTok sidelined, major players in the social media space stand to benefit. Meta Platforms (META), the parent company of Facebook and Instagram, is poised to capture a significant portion of TikTok’s advertising dollars. Analysts estimate that as much as 70% of TikTok’s ad spend could migrate to Instagram, where ad monetization rates are approximately three times higher.

Snapchat (SNAP), another TikTok competitor, could also see an influx of users and ad revenue. However, experts caution that Snap must ensure it retains these users long-term to sustain growth. Meanwhile, Reddit (RDDT) offers an alternative with its own short-form video features and vibrant community forums, potentially appealing to displaced TikTok users.

Google and Apple might indirectly benefit as well. Both companies could see increased revenue from app developers vying to replace TikTok in the U.S. market.

Uncertain Path Ahead

Although TikTok has hinted at a potential reprieve under Trump, its future is far from assured. The company may be forced to divest its U.S. operations or make other concessions to resume its services. In the meantime, alternative apps like RedNote and Lemon8 are seeing a surge in downloads as users seek substitutes for TikTok’s addictive format.

For tech giants like Meta and Google, the TikTok ban represents an unprecedented opportunity to reclaim market share and bolster their dominance in the social media space. However, it also serves as a reminder of the precarious relationship between technology and geopolitics—a dynamic that will continue to shape the industry in the years to come.

As the dust settles, one thing is clear: the absence of TikTok has created a vacuum in the digital ecosystem, and the race to fill it is only just beginning.

Although TikTok has hinted at a potential reprieve under Trump, its future is far from assured. The company may be forced to divest its U.S. operations or make other concessions to resume its services. In the meantime, alternative apps like RedNote and Lemon8 are seeing a surge in downloads as users seek substitutes for TikTok’s addictive format.

For tech giants like Meta and Google, the TikTok ban represents an unprecedented opportunity to reclaim market share and bolster their dominance in the social media space. However, it also serves as a reminder of the precarious relationship between technology and geopolitics—a dynamic that will continue to shape the industry in the years to come.

As the dust settles, one thing is clear: the absence of TikTok has created a vacuum in the digital ecosystem, and the race to fill it is only just beginning.

Considering a $1,000 investment in these companies?

Our team at Stock Investor carefully curated a list of top stocks with the potential for significant returns, suitable for beginners and seasoned investors alike who are eager to learn a trade and unearth the best stocks to buy. Though not featured in this article, these selected stocks could be game-changers in the future.For those seeking dynamic trading experiences, consider joining our Swing Trade Alerts, Option Income Alert, or our Trading Room. Take advantage of our special offer today, starting at just $1 in the first month.

Unlock the secrets of Smart Money

Explore how billionaires and institutions are influencing the market. Follow their every move with DarkOption Flow and stay updated on essential market insights. Begin your journey to informed investing today!

Education

And if you're a fan of Invest opedia, you'll appreciate what we offer at SharperTrades even more. Explore our comprehensive option trading course and technical trading course, where you can learn trading, analyze stocks, delve into chart patterns for stocks, and gain invaluable insights for making the best company investments.

Unlock Your Stock Market Edge with SharperTrades. Dive into powerful trading tools, learn a trade, and receive expert guidance. Stay up-to-date with regular market updates. Learn trading, basics of investing, and how to pick the best stocks to buy. Whether you're a beginner or seasoned investor and trader, we've got you covered. Get started for free, today!