Super Micro Computer (SMCI), a significant player in the AI-driven tech boom, faced a brutal market response as its stock plummeted by 24% early Wednesday.

The sharp drop followed the company’s announcement that it would delay filing its annual report for the fiscal year ending June 30. The delay comes on the heels of a damaging report from short-seller Hindenburg Research, which accused the company of “accounting manipulation” and other serious allegations.

A Rising Star Caught in Controversy

Super Micro had been a darling of the stock market, with shares soaring from $290 in January to nearly $1,200 by March. The company’s inclusion in the S&P 500 further fueled its rise, as investors flocked to capitalize on its role in the AI revolution. However, the euphoria has been tempered by recent events, as the stock has now shed more than 60% of its value from its peak. Despite these setbacks, Super Micro remains up 50% year to date, a testament to its rapid growth in the AI sector. The company’s recent announcement of a 10-for-1 stock split, effective October 1, was meant to attract more investors but has been overshadowed by the current turmoil.

The allegations from Hindenburg Research have cast a shadow over Super Micro’s achievements. The report detailed “glaring accounting red flags,” undisclosed related party transactions, and other potential violations. Hindenburg’s investigation has raised questions about Super Micro’s internal controls and business practices, leading to a wave of investor skepticism. The timing of these allegations, just before Super Micro’s delayed filing, has intensified concerns about the company’s governance and transparency.

Super Micro had been a darling of the stock market, with shares soaring from $290 in January to nearly $1,200 by March. The company’s inclusion in the S&P 500 further fueled its rise, as investors flocked to capitalize on its role in the AI revolution. However, the euphoria has been tempered by recent events, as the stock has now shed more than 60% of its value from its peak. Despite these setbacks, Super Micro remains up 50% year to date, a testament to its rapid growth in the AI sector. The company’s recent announcement of a 10-for-1 stock split, effective October 1, was meant to attract more investors but has been overshadowed by the current turmoil.

The allegations from Hindenburg Research have cast a shadow over Super Micro’s achievements. The report detailed “glaring accounting red flags,” undisclosed related party transactions, and other potential violations. Hindenburg’s investigation has raised questions about Super Micro’s internal controls and business practices, leading to a wave of investor skepticism. The timing of these allegations, just before Super Micro’s delayed filing, has intensified concerns about the company’s governance and transparency.

The AI Gold Rush: Opportunities and Pitfalls

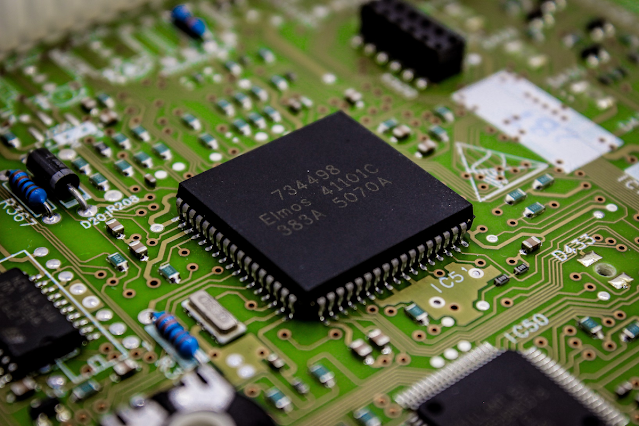

Super Micro’s troubles highlight the volatility and risks associated with the AI-driven tech boom. The company’s fortunes have been closely tied to the rise of AI, particularly its partnership with Nvidia (NVDA), the leading AI chipmaker. Nvidia’s (NVDA) dominance in the AI market has lifted many companies, including Super Micro, which supplies data center servers and management software integral to AI operations. However, the rapid growth in the AI sector has also attracted scrutiny, with investors and regulators increasingly wary of the hype surrounding AI stocks.

Super Micro’s troubles highlight the volatility and risks associated with the AI-driven tech boom. The company’s fortunes have been closely tied to the rise of AI, particularly its partnership with Nvidia (NVDA), the leading AI chipmaker. Nvidia’s (NVDA) dominance in the AI market has lifted many companies, including Super Micro, which supplies data center servers and management software integral to AI operations. However, the rapid growth in the AI sector has also attracted scrutiny, with investors and regulators increasingly wary of the hype surrounding AI stocks.

Nvidia, a key supplier for Super Micro, continues to thrive, with its stock up nearly 160% year to date. The AI juggernaut is set to report its second-quarter earnings, with expectations of a significant increase in both revenue and profits. Nvidia’s success has been a major catalyst for Super Micro, but the recent controversy threatens to derail the smaller company’s momentum. As the AI market matures, companies like Super Micro will need to navigate not only the opportunities but also the challenges that come with rapid growth and heightened expectations.

Navigating the Future in a Competitive Landscape

The road ahead for Super Micro is uncertain, as it grapples with both the fallout from Hindenburg’s report and the broader challenges of sustaining growth in a competitive market. The company’s delay in filing its annual report has only added to the uncertainty, raising questions about its internal controls and the accuracy of its financial reporting. For investors, the recent developments serve as a stark reminder of the risks inherent in high-flying tech stocks, especially those tied to emerging technologies like AI.

As the AI market continues to evolve, companies will face increasing pressure to deliver on their promises while maintaining robust governance and transparency. Super Micro’s ability to address the concerns raised by Hindenburg and reassure investors will be crucial to its future success. Meanwhile, the broader AI sector remains a dynamic and potentially lucrative space, with opportunities for those who can navigate its complexities and pitfalls.

Considering a $1,000 investment in these companies?

Our team at Stock Investor carefully curated a list of top stocks with the potential for significant returns, suitable for beginners and seasoned investors alike who are eager to learn a trade and unearth the best stocks to buy. Though not featured in this article, these selected stocks could be game-changers in the future.For those seeking dynamic trading experiences, consider joining our Swing Trade Alerts, Option Income Alert, or our Trading Room. Take advantage of our special offer today, starting at just $1 in the first month.

Unlock the secrets of Smart Money

Explore how billionaires and institutions are influencing the market. Follow their every move with DarkOption Flow and stay updated on essential market insights. Begin your journey to informed investing today!

Education

And if you're a fan of Invest opedia, you'll appreciate what we offer at SharperTrades even more. Explore our comprehensive option trading course and technical trading course, where you can learn trading, analyze stocks, delve into chart patterns for stocks, and gain invaluable insights for making the best company investments.

Unlock Your Stock Market Edge with SharperTrades. Dive into powerful trading tools, learn a trade, and receive expert guidance. Stay up-to-date with regular market updates. Learn trading, basics of investing, and how to pick the best stocks to buy. Whether you're a beginner or seasoned investor and trader, we've got you covered. Get started for free, today!