Nvidia's (NVDA) shares experienced an uptick on Thursday, buoyed by positive developments regarding the demand for artificial-intelligence chips from Taiwan Semiconductor Manufacturing (TSM).

Despite a brief dip at the market's opening, Nvidia's shares climbed nearly 2% to $855, showing signs of recovery. The previous day had seen Nvidia's stock close down 4%, alongside a broader decline in the semiconductor sector. This downturn followed ASML Holding's (ASML) announcement of first-quarter orders falling below expectations, contributing to market jitters.

AI Growth Prospects Amid Pricing Concerns

Taiwan Semiconductor Manufacturing, the world's leading contract chip maker and a key supplier for Nvidia's chips, provided a mixed outlook on demand and pricing. While TSMC reported a revenue boost in the first quarter driven by demand for AI chips, concerns regarding pricing were also raised.

According to reports, TSMC's CEO anticipates AI-related chips to represent over 10% of the company's total revenue this year, with projections to reach 20% by 2028. This outlook indicates a strong growth trajectory for AI-related revenue, including Nvidia's graphics-processing units for data centers and AI accelerators.

Analysts like Charles Shi from Needham view TSMC's extended growth forecast for AI as a positive development for the AI semiconductor sector. However, TSMC's plans to double its advanced chip-packaging capacity by the end of 2024 may not fully address the ongoing capacity shortage until next year.

TSMC's Potential Price Hikes Could Impact Nvidia

One potential concern for Nvidia is the possibility of price hikes by TSMC, hinted at during discussions with analysts. This could be linked to TSMC's significant investment in chip-manufacturing plants in Arizona, which founder Morris Chang has suggested may increase production costs compared to Taiwan.

Despite these uncertainties, Nvidia's stock performance remains strong, with a year-to-date increase of 70% as of Wednesday's close. In comparison, the S&P 500 index and the Nasdaq Composite Index saw gains of 5.3% and 4.5%, respectively, over the same period.

Taiwan Semiconductor Manufacturing, the world's leading contract chip maker and a key supplier for Nvidia's chips, provided a mixed outlook on demand and pricing. While TSMC reported a revenue boost in the first quarter driven by demand for AI chips, concerns regarding pricing were also raised.

According to reports, TSMC's CEO anticipates AI-related chips to represent over 10% of the company's total revenue this year, with projections to reach 20% by 2028. This outlook indicates a strong growth trajectory for AI-related revenue, including Nvidia's graphics-processing units for data centers and AI accelerators.

Analysts like Charles Shi from Needham view TSMC's extended growth forecast for AI as a positive development for the AI semiconductor sector. However, TSMC's plans to double its advanced chip-packaging capacity by the end of 2024 may not fully address the ongoing capacity shortage until next year.

TSMC's Potential Price Hikes Could Impact Nvidia

One potential concern for Nvidia is the possibility of price hikes by TSMC, hinted at during discussions with analysts. This could be linked to TSMC's significant investment in chip-manufacturing plants in Arizona, which founder Morris Chang has suggested may increase production costs compared to Taiwan.

Despite these uncertainties, Nvidia's stock performance remains strong, with a year-to-date increase of 70% as of Wednesday's close. In comparison, the S&P 500 index and the Nasdaq Composite Index saw gains of 5.3% and 4.5%, respectively, over the same period.

TD Cowen Adjusts Targets for TSMC and Advanced Micro Devices

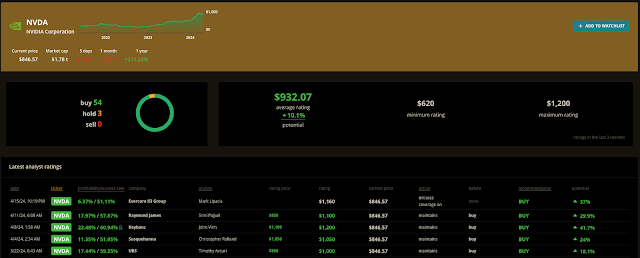

In related news, Taiwan Semiconductor Manufacturing's target was raised to $130 by TD Cowen, while Advanced Micro Devices (AMD) received a target increase to $200. Nvidia holds an average rating of $932, with Keybanc analyst John Vinh providing the highest rating and a price target of $1200.

In related news, Taiwan Semiconductor Manufacturing's target was raised to $130 by TD Cowen, while Advanced Micro Devices (AMD) received a target increase to $200. Nvidia holds an average rating of $932, with Keybanc analyst John Vinh providing the highest rating and a price target of $1200.

These updates reflect analysts' assessments of the semiconductor market and the performance of key players like Nvidia and AMD amid evolving industry dynamics.

Although TSMC's robust first-quarter revenue growth indicates promise for the sector, lingering concerns about pricing and capacity shortages persist. Despite these challenges, Nvidia's resilience and strategic positioning indicate its capability to navigate industry headwinds and seize emerging opportunities in the AI semiconductor sector.

Interested in making informed trading and investing decisions?

- Explore our Stock Investor service for insightful investing strategies.

- If you are looking for dynamic trading experiences, check out Basic+ | Swing Alert, Option Income Alert, or our Trading Room. Sign up today for as little as $1 in the first month.

Unlock the Secrets of Smart Money | Discover how billionaires and institutions are shaping the market. Track their every move with DarkOption Flow and never miss out on crucial market insights. Start your journey to informed investing today!

- Explore our Stock Investor service for insightful investing strategies.

- If you are looking for dynamic trading experiences, check out Basic+ | Swing Alert, Option Income Alert, or our Trading Room. Sign up today for as little as $1 in the first month.