Investing is a long-term strategy.

At the same time, let's face it, the past couple of months have been challenging.

Many of our growth stocks are down double digits, including our highest convictions Airbnb (ABNB), Tesla (TSLA), Coinbase (COIN), Snowflake (SNOW) and Zoom (ZM).

It's difficult seeing stocks that we believe in, take such hard falls. That's investing. What goes up must come down. What comes down must go up.

Traders and Investors Mindsets

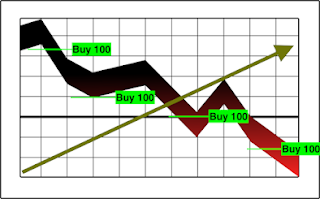

This is where pullbacks and drops in market value become great buying opportunities for long-term investors.

For traders, timing is everything.

A stock bought at the beginning of a pullback can easily become a huge loser. The same stock bought at the end of a pullback can instead, turn out to be an awesome winner.

For investors, on the other end, time is an ally.

When price runs to all time highs, investors are pleased with their company performance. When price drops to some painful lows, they remain calm and buy the dip. Time is their friend.

During times of heightened volatility, those rallies can be really exciting and the drops can cause serious anxiety and sleepless nights.

How do we deal with that? Know your strategy.

Know your Strategy

If you are trader, you need to time your entries and exits precisely (buy lows, sell high type of thing). If you are an investor, you don't.

As an investor, your "only" job is to find solid companies that are well-positioned to be market leaders and to gradually start building your positions.

When you do that, volatility becomes a temporary event.

Rather than disrupting your life and causing you sleepless nights, volatility provides you with buying opportunities and cheaper deals.

The job of an investor becomes more difficult if the person is also a trader. The way to deal with that is: "You gotta keep 'em separated."

The way to keep the two mindsets and strategies separated is by having two separate accounts:

- one account for trading, which you need to monitor everyday;

- one account for investing, which you only monitor once a month (once a week if you really, really, really, really have to... But try not to)

Only Invest Money You Don't Need for Living

First of all, make sure that the money you need in the next 2-3 years to pay for living expanses, but not limited to (including bills, mortgages, down payments, retirement expenses...), are not invested in stocks.

Then, always try keeping some of your money available as cash.

This strategy is especially important during bearish markets. However, it is a good idea to keep some cash available also during bullish runs.

Buy the Dip

Not only extra cash avails for some wiggle room. Keeping cash available gives investors the chance to take advantage of buying opportunity, and when appropriate, to buy stocks at lower prices.

The general public see market drops as Godzillas to run away from.

While it's also human to second-guess our decisions, informed investors try not to.

Instead they see market drops as opportunities to buy their conviction stocks at discounted prices, and to average down. (Averaging down is the act of purchasing additional shares of a previously initiated investment with the intention of decreasing the average stock price.)

Reassessing Strategies and Plans

At the same time, market drops are also opportunities to reassess strategies and plans.

If you need help with portfolio allocation, please check out our asset allocation tools to explore a variety of long-term investment strategies and plans.

Again, it's important to monitor your portfolio performance.

However, we live in a 24-hour news cycle society, and during volatile times that cycle can turn our lives into an emotional rollercoaster. If that's the case, it's essential to step away from it.

As long as your portfolio is in line with your long-term plans, volatility is just a temporary event.

Of course, we don't want to minimize the frustration that many investors are feeling as a result of it. We feel it too.

At the same time, long-term investing is a proven strategy.

Investors have been through challenging times before and came out stronger, and wiser. This time is no different. We succeeded it before. We will do again, together.

Good Investing!

Stock Investor Management Team

@SharperTrades

Risk Disclaimer

SharperTrades, LLC is not registered as an investment adviser with any federal or state regulatory agency. All information shared is provided for educational purposes only. Any trades placed upon reliance of SharperTrades, LCC are taken at your own risk for your own account. Past performance is no guarantee. While there is great potential for reward trading stocks, commodities, options and forex, there is also substantial risk of loss. All trading operations involve high risks of losing your entire investment. You must therefore decide your own suitability to trade. Trading results can never be guaranteed. This is not an offer to buy or sell cryptos, stocks, forex, futures, options, commodity interests or any other trading security.